At JigNect Technologies, we deliver secure, high-performance, and regulation-compliant software testing for Banking, Financial Services, and Insurance (BFSI) applications. With our specialized BFSI testing services, we ensure that critical financial applications are robust, secure, and meet industry compliance standards.

Financial Data Security & Compliance

- Encrypt sensitive banking data end-to-end.

- Implement role-based access control (RBAC).

- Ensure compliance with PCI-DSS, GDPR, and SOX.

- Protect online transactions and customer accounts.

Data Integrity & Accuracy

- Validate accurate financial records and statements.

- Prevent data duplication, loss, and fraud.

- Ensure precise calculations for interest, tax, and payments.

- Sync real-time transactional data across systems.

System Integration & API Testing

- Test seamless integration with core banking systems and APIs.

- Validate compatibility with payment gateways, CRM, and KYC/AML systems.

- Ensure seamless interaction with financial modules and external services.

- Enable real-time financial data exchange with minimal disruption.

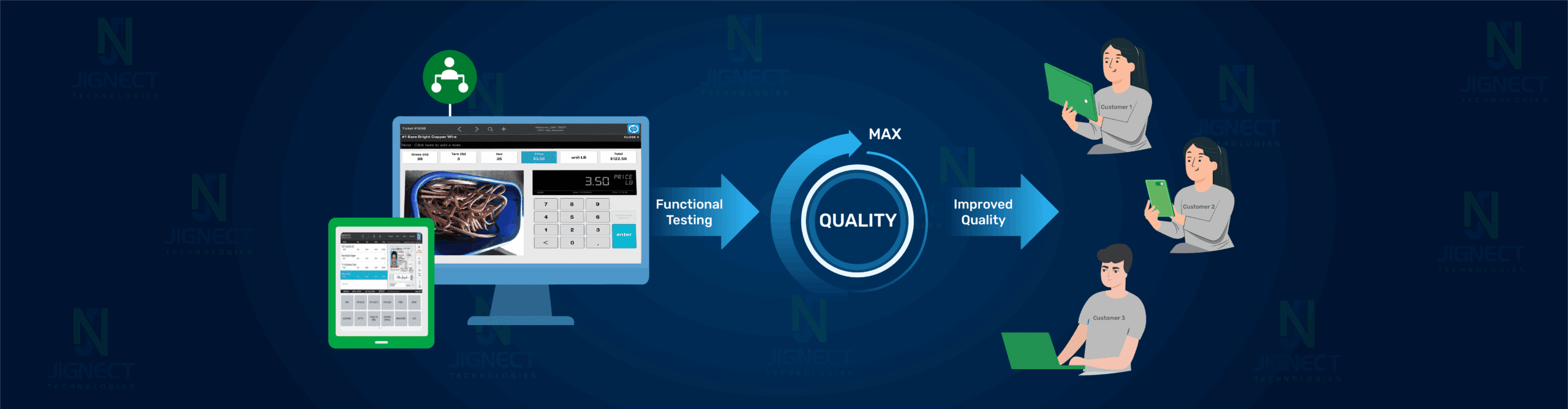

Banking Workflow & Functional Testing

- Test full workflows—account creation, loan processing, transactions, and customer onboarding.

- Validate business rules and decision logic for accurate financial processing.

- Use automation frameworks to simulate end-to-end BFSI operations.

Performance Testing & Scalability

- Ensure app stability under high load conditions—month-end closures, IPOs, etc.

- Optimize mobile banking app speed and transaction processing time.

- Test scalability for digital wallets, online trading, and customer portals.

- Guarantee zero downtime during peak hours.

User Experience (UX) & Accessibility

- Deliver intuitive user interfaces for web and mobile banking apps.

- Validate multi-language support, WCAG accessibility, and screen reader compatibility.

- Enhance UX across retail, corporate, and neo banking platforms.

- Enhance user satisfaction across digital banking platforms.

Billing, Claims & Transaction Validation

- Verify transaction logs, billing records, and payment receipts as part of financial application testing to ensure accurate financial data management.

- Test anti-money laundering (AML), fraud detection systems, and claims processing through robust insurance software testing practices.

- Validate tax calculation and audit-readiness to support reliable financial operations.

Risk Management & Downtime Readiness

- Test real-time fraud alerts, risk scoring systems, and blacklist modules.

- Validate disaster recovery, data backups, and failover plans.

- Ensure business continuity and minimize disruption during outages or system upgrades.

Why Choose JigNect for BFSI Software Testing?

Industry Experts

With domain-driven QA expertise in fintech, we specialize in core banking, payments, and wealth management software testing to ensure secure, reliable performance for financial platforms.

Regulatory Compliance

AI-Powered Efficiency

Accelerate QA cycles using AI-based test automation, predictive analytics, and real-time insights for faster go-to-market.

Seamless Integration

Test banking APIs, payment gateways, credit bureaus, insurance platforms, and legacy systems for smooth operations.

Scalability & Performance

Optimize BFSI applications to handle peak loads, concurrent transactions, and real-time financial processing - critical for high-availability systems.

Trusted by 50+ businesses across the globe

10 +

50 +

75 +

100 +

Why Partner with JigNect?

Frequently Asked Questions (FAQs)

Why is software testing important in the BFSI industry?

It ensures secure, compliant, and high-performing applications. Helps detect bugs early, reduce financial risks, and build customer trust.

What types of BFSI applications do you test?

We test platforms like core banking systems, internet/mobile banking apps, insurance portals, investment platforms, credit scoring systems, and fintech solutions.

How do you ensure regulatory compliance in BFSI testing?

Can you help with performance testing for financial systems?

Do you offer automation testing for BFSI?

How do you test for cybersecurity threats?

We perform vulnerability assessments, code analysis, penetration testing, and secure API testing to prevent fraud and data breaches.